Approaches for Cost-Effective Offshore Company Development

When thinking about overseas company formation, the mission for cost-effectiveness comes to be a paramount worry for companies seeking to increase their operations internationally. In a landscape where financial prudence rules supreme, the strategies utilized in structuring offshore entities can make all the distinction in accomplishing economic performance and functional success. From browsing the intricacies of territory option to implementing tax-efficient structures, the journey towards establishing an offshore existence is swarming with chances and difficulties. By discovering nuanced strategies that mix lawful conformity, monetary optimization, and technological improvements, services can start a path towards offshore company development that is both financially sensible and tactically sound.

Choosing the Right Jurisdiction

When developing an offshore firm, choosing the suitable jurisdiction is a critical choice that can substantially impact the success and cost-effectiveness of the development process. The territory selected will certainly figure out the regulatory structure within which the company runs, affecting taxes, reporting requirements, personal privacy laws, and total company adaptability.

When selecting a territory for your overseas business, several variables should be considered to make sure the decision lines up with your critical goals. One critical element is the tax obligation program of the territory, as it can have a significant influence on the firm's success. Furthermore, the degree of regulatory conformity called for, the economic and political security of the territory, and the ease of operating has to all be assessed.

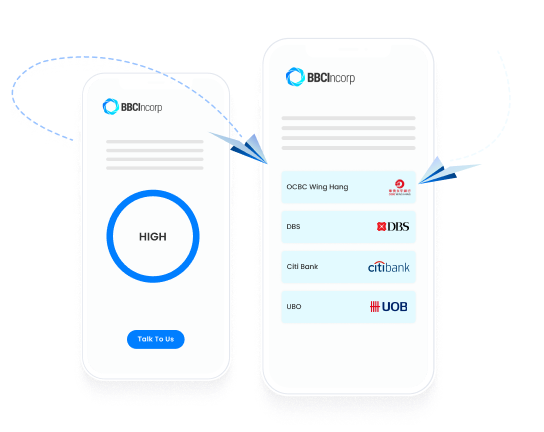

Additionally, the reputation of the jurisdiction in the worldwide service community is crucial, as it can influence the understanding of your business by clients, companions, and banks - offshore company formation. By thoroughly analyzing these factors and seeking expert recommendations, you can pick the right jurisdiction for your offshore company that optimizes cost-effectiveness and supports your company goals

Structuring Your Firm Effectively

To ensure ideal efficiency in structuring your offshore firm, precise focus must be offered to the business framework. The very first step is to define the business's possession structure clearly. This consists of determining the shareholders, police officers, and supervisors, in addition to their obligations and functions. By developing a clear possession framework, you can ensure smooth decision-making procedures and clear lines of authority within the business.

Next, it is crucial to consider the tax obligation implications of the chosen framework. Various territories supply differing tax obligation advantages and motivations for overseas firms. By meticulously assessing the tax obligation regulations and laws of the picked jurisdiction, you can enhance your company's tax performance and decrease unneeded costs.

Moreover, preserving proper documentation and documents is crucial for the reliable structuring of your overseas business. By keeping accurate and up-to-date documents of monetary deals, business decisions, and compliance documents, you can ensure transparency and responsibility within the organization. This not just facilitates smooth operations but additionally assists in demonstrating conformity with governing needs.

Leveraging Technology for Financial Savings

Effective structuring of your offshore firm not only rests on thorough interest to organizational structures but additionally on leveraging innovation for financial savings. In today's electronic age, technology plays a crucial function in streamlining procedures, reducing expenses, and increasing performance. One way to utilize technology for financial savings in offshore business formation is by using cloud-based solutions for data storage space and collaboration. Cloud innovation eliminates the requirement for pricey physical infrastructure, minimizes maintenance expenses, and gives flexibility for remote work. In addition, automation tools such as digital trademark systems, accounting software program, and project administration systems can significantly minimize hand-operated labor costs and enhance total productivity. Accepting on-line interaction tools like video conferencing and messaging applications can additionally cause set you back financial savings by decreasing the requirement for traveling expenditures. By incorporating innovation tactically right into your overseas company formation process, you can accomplish substantial savings while enhancing operational efficiency.

Lessening Tax Obligation Responsibilities

Making use of calculated tax obligation planning techniques can efficiently decrease the financial burden of tax obligation responsibilities for offshore companies. Among one of the most typical methods for minimizing tax obligation obligations is with revenue changing. By dispersing earnings to entities in low-tax territories, overseas business can lawfully decrease this content their general tax commitments. In addition, taking benefit of tax motivations and exemptions offered by the territory where the offshore firm is registered can result in significant cost savings.

One more approach to lessening tax obligation obligations is by structuring the overseas company in a tax-efficient way - offshore company formation. This entails very carefully designing the possession and functional structure to enhance tax obligation benefits. Establishing up site web a holding business in a territory with favorable tax legislations can aid decrease and settle profits tax exposure.

Moreover, staying updated on worldwide tax obligation laws and compliance requirements is vital for reducing tax obligation liabilities. By making sure rigorous adherence to tax obligation regulations and laws, overseas firms can stay clear of pricey fines and tax obligation disagreements. Looking for specialist suggestions from tax obligation professionals or lawful specialists concentrated on global tax obligation issues can likewise supply useful understandings into efficient tax planning strategies.

Guaranteeing Compliance and Risk Reduction

Implementing durable conformity steps is crucial for overseas firms to minimize risks and keep governing adherence. Offshore jurisdictions frequently deal with increased scrutiny because of worries concerning cash laundering, tax evasion, and other economic criminal offenses. To make sure conformity and alleviate dangers, offshore business ought to carry out complete due diligence on customers and service partners to stop participation in illicit tasks. Additionally, implementing Know Your Client (KYC) and Anti-Money Laundering (AML) procedures can aid verify the authenticity of transactions and guard the company's online reputation. Routine audits and reviews of economic records are critical to determine any kind of irregularities or non-compliance concerns quickly.

Additionally, remaining abreast of changing regulations and legal needs is vital for overseas companies to adjust their conformity practices accordingly. Engaging legal professionals or conformity consultants can offer beneficial advice on navigating complex regulatory landscapes and making sure adherence to global criteria. By focusing on conformity his comment is here and risk mitigation, offshore companies can enhance transparency, build count on with stakeholders, and protect their operations from prospective legal consequences.

Final Thought

Making use of tactical tax obligation planning techniques can efficiently lower the economic problem of tax obligation responsibilities for overseas firms. By dispersing earnings to entities in low-tax territories, overseas firms can legitimately decrease their total tax obligation commitments. In addition, taking benefit of tax obligation rewards and exceptions used by the jurisdiction where the offshore company is registered can result in substantial savings.

By ensuring stringent adherence to tax legislations and policies, offshore firms can stay clear of pricey charges and tax disputes.In conclusion, cost-effective overseas business formation requires careful factor to consider of territory, reliable structuring, innovation use, tax reduction, and conformity.